These Companies Started Laying Off Employees Right After Taking Trump’s Tax Cuts.

1. Pfizer : If you need a summary of the state of U.S. healthcare, simply check the plans Pfizer announced in January 2018. According to Reuters, the company valued at $53 billion is cutting 300 research jobs in New England.

Those employees conducted tests on drugs aimed at treating Alzheimer’s and Parkinson’s disease. Pfizer, which will continue onward with drugs like Viagra, is set to save billions from Trump’s tax cuts.

Next: Trump spoke too soon about this company’s moves after the tax cuts passed.

2. AT&T : “AT&T plans to increase U.S. capital spending $1 billion and provide $1,000 special bonus to more than 200,000 U.S. employees, and that’s because of what we did,” Trump told the nation on December 20.

That same night, hundreds of AT&T employees in Missouri learned they were being fired just in time for Christmas. Trump did not follow up with a statement on that development, but the local union president did.

“How can you lay people off and then give them $1,000 and say that there’s going to be more jobs available? I wish someone could tell me how that’s possible,” said Joseph Blanco of the Communication Workers of America Union.

AT&T continued announcing layoffs into the new year. At last count, some 4,000 people were expected to lose their jobs.

Next: This $42 billion company announced it will lay off at least 5,000 U.S. employees while closing 10 plants.

3. Kimberly-Clark : Kimberly-Clark, the $42 billion company behind Huggies diapers and Kleenex tissues, said it would shut down 10 factories and lay off up between 5,000 and 5,500 workers in 2018, the Washington Post reported on January 23. The Dallas-based company spoke in terms of global strategy about the move, which affects 13% of its employees.

“We anticipate ongoing annual cash flow benefits from tax reform,” CFO Maria Henry said in a conference call. Henry added that Kimberly-Clark now had the “flexibility to continue to allocate significant capital to shareholders” during its “restructuring program.”

* A case in point rebuttal that potentiates a discredit in claim : Since the Trumpenator signed that legislation, corporations have used the majority of their newfound wealth to fund enormous share repurchase plans, which fatten their stock prices while diminishing the power of shareholders. * Since executive compensation at the upper levels is based primarily on stock price, the fat cats in the C suites now have billions more in personal wealth than they did 6 months ago. Meanwhile, Congress is hard at work figuring out how to slash funding for Medicare and Medicaid while eviscerating Social Security to pay for that billionaire booster.

So shareholders will get more money while thousands of workers get pink slips. These jobs won’t come back, and businesses near the shuttered factories will also feel the impact.

Next: One of America’s most hated corporations dropped hundreds of employees before Christmas.

4. Comcast : What was a $199 billion company to do? Tax reform obviously had the votes in the GOP Congress and would pass. In Comcast’s case, the company stood to gain over $12 billion in a single year.

So the corporation quietly fired over 500 sales employees in the Southeast and Midwest, the Philadelphia Inquirer confirmed. Those cuts came right before Christmas.

Comcast said the $1,000 bonus it splashed across the news would serve as severance for the laid-off employees. However, we learned the real benefits of tax reform in the final week of January.

Comcast raised stockholder dividend payouts 21% and said it will do $5 billion in stock buybacks in 2018. Compared to the $171 million it spent on employee bonuses, the cable giant spent 30 times as much on shareholders.

Next: This iconic American manufacturer shut down a factory as it outsourced work to Thailand.

5. Harley-Davidson : In February 2017, Harley-Davidson executives and employees brought several motorcycles to the White House as Trump posed for pictures with them, touting the return of American manufacturing. One year (and one 40% tax cut) later, Harley announced it would close its Kansas City plant and lay off 800 workers there.

The massive layoffs did not come off like a White House photo op, however. “They didn’t even give us a call ahead of time,” a union representative told The Kansas City Star. Harley is opening a plant in Thailand for 2018, so it isn’t hard to see what happened here.

Next: America’s biggest employer didn’t hesitate to lay off thousands of workers after securing its tax plan windfall.

6. Walmart : With Walmart, the country’s biggest employer, there were a couple of stories going around. First, we heard the company’s decision to raise the minimum wage for some employees and give bonuses to others. This PR move made it all the way to the White House, and Trump celebrated in his usual fashion. However, there was bad news that same day.

On January 11, the company abruptly closed 63 of its Sam’s Club stores, affecting thousands of employees. The company said some employees could find work in other locations; others wouldn’t. Apparently, the $313-billion company’s newfound billions could not protect these low-wage jobs.

Next: The tech sector contributed many layoffs as well.

7. Microsoft : When you’re Microsoft, a tech giant with a market cap over $700 billion, the GOP tax plan was music to your ear. After all, Microsoft could repatriate $128 billion to the U.S. at discount tax rates.

None of that was enough to save “hundreds of employees” at Microsoft who got the axe in the final week of January. They’ll have to look for jobs elsewhere as the administration’s big move didn’t help.

Next: Tax reform couldn’t save an extra 700 layoffs at this health care company.

8. Tenet Healthcare : Several strange things happened with Tenet Healthcare, a company worth billions, both before and after Congress passed the tax plan. First, the company announced it would raise the number of jobs it was eliminating from 1,300 to 2,000 employees, with several hundred coming at Detroit Medical Center. The following day, the company’s stock price began a climb that left shares up nearly 25% within two weeks.

When people warned that CEOs would simply take the extra millions from tax reform and give it to top shareholders, they were probably referring to this type of scenario.

Next: This European company took its tax plan windfall and eliminated dozens of Indiana workers.

9. Schneider Electric : If Indiana workers didn’t like the deal Trump and Vice President Mike Pence made with Carrier, maybe they hoped for better from European company Schneider Electric. After all, foreign investors were set to pocket $70 billion in just one year under the tax plan.

Unfortunately, in yet another sign capital investment and taxes are unrelated, Schneider announced 61 workers at an Indiana facility would lose their jobs in 2018.

Next: This $204 billion company couldn’t afford to keep 53 Atlanta-area employees.

10. Coca Cola : When you hear of a company with a $204 billion market cap letting 53 employees go, you have to really worry about its state of affairs. If so, direct your concerns toward Coca Cola, the beverage giant that took its tax cut and laid off dozens of employees from a Georgia plant.

Reductions in the corporate tax rate (now way down at 20%) allow Coke executives to play with billions, but these low-wage jobs simply could not be saved.

Next: Speaking of Carrier, do you hear how many jobs the company eliminated in January 2018?

11. Carrier : You may remember the Carrier episode from December 2016 in a few different ways. For Trump and Pence, it was a great day for America as the company got a $7 million tax break in exchange for keeping a few hundred jobs in Indiana.

Those who worked inside the plant saw it a different way: as a PR spectacle that meant nothing when it came to saving jobs.

One year later, with its corporate tax rate slashed, Carrier laid off 215 employees in January 2018. Those jobs went directly to Mexico, where workers will earn $3 per hour, Reuters reported.

Next: Dozens of employees won’t run on Dunkin’ anymore.

12. Dunkin’ Donuts : Finally, we close with Dunkin’ brands, a company with a $6 billion market cap. In total, the company said it would eliminate 40 jobs that are currently filled and leave another 40 unfilled jobs that way around the globe.

Apparently, those millions in saved taxes won’t help the company keep its U.S. employees — or fill jobs that it had staffed in the past. If we didn’t know any better, we’d say corporations didn’t think about employees when it planned what to do with their money.

If You Work 1 of These Jobs, Trump’s Tax Plan Won’t Help You.

Most people have one question about the Republican tax plan: What’s in it for me? If you’re a billionaire and/or member of President Donald Trump’s Cabinet, you know you’ll get a massive tax cut.

The plan will not be as kind to the average American. An analysis by the nonpartisan Tax Policy Center showed why some members of Congress should probably hide from constituents these days.

Within a decade, “taxes would rise for roughly one-quarter of taxpayers, including nearly 30 percent of those with incomes between about $50,000 and $150,000,” the authors wrote. The Tax Policy Center projected the biggest winners would be those earning over $730,000. (The so-called “death tax,” which would end, only affects estates with values over $5.4 million.)

Keeping those numbers in mind, we looked at the jobs that will be taxed higher as the 1% gets richer. If you work in these professions, you’ll see little benefit and might pay more in taxes under the GOP plan.

Elementary school teacher

According to PayScale, the median salary for elementary school teachers tops $50,000 in large U.S. cities. Houston teachers earned a median salary of $52,056 in 2015, and many of those individuals could pay more in taxes over the next decade.

Teachers in this income bracket fall under the “middle quintile,” where people earn between $47,400 and $69,700. According to Tax Policy Center, 28% of that group would pay an extra $1,290 by the next decade. Otherwise, your tax break would net you $1,100.

Next: This profession wasn’t the driver behind the tax plan.

Truck driver

According to the U.S. Bureau of Labor, there are over 1.6 million heavy truck drivers in America, making it the 13th most common job in the country. Drivers of tractor trailers and semis earn an average of $42,500, which lands this profession in the second quintile. Unless the GOP plan changes drastically, truckers will not be winning from this version of “tax reform.” Many would see a $460 bump in annual income, while nearly 20% would have their tax bill rise an average of $510, the Tax Policy Center analysis predicted.

Next: This largely female workforce will not be a big winner.

Registered nurse

The median salary for a registered nurse stands just above $60,000, putting this profession in the crosshairs of the tax proposal. According to the Tax Policy Center analysis, nurses without advanced degrees would see a maximum change of 0.5% in their after-tax income (about $1,000). By contrast, America’s top earners would see a 10% boost in income, which would mean billions more for the world’s richest.

Next: After a day full of bad news, these workers won’t want to hear about tax reform.

Customer service rep

If customer service representatives hoped for relief from angry callers, they won’t find much in this tax plan. Things would start out as promising, however. The Tax Policy Center estimated reps earning the average salary of $33,000 would see an extra $370 in 2018. (Just over 6% would see taxes increase by $530.) However, compared to the extra $146,470 headed for America’s top 1%, customer service professionals would get a tiny slice of the pie.

Next: This group will see more callouses before tax relief.

Warehouse laborer

According to the Department of Labor, about 2.5 million Americans work as warehouse stockers and general laborers. That places this profession among the most common in the country. Going by Trump’s speech in Harrisburg on Oct. 11, laborers might believe a tax break is headed their way.

“[O]ur framework ensure that the benefits of tax reform go to the middle class, not to the highest earners,” Trump said. However, the numbers in the Tax Policy Center analysis suggest otherwise. Laborers ear an average of $27,800, landing this profession in the second quintile. Many could see a minor income boost ($460), but about 20% would see a $510 tax increase in the next decade.

Next: The Buffett rule still won’t apply here.

Administrative assistant

Warren Buffett famously questioned why his secretary paid a higher tax rate than he did. (Buffett’s net worth topped $81.5 billion in October 2017.) Unfortunately, the situation will get worse if this tax plan lands on the president’s desk. Assuming an average salary of $35,000 for secretaries, this profession sits in the tax group that has little to gain and something to lose. The luckiest would pocket an extra $460 a year; the rest would pay over $500 more to Uncle Sam.

Next: This profession seems unrepresented during the drafting of the tax plan.

Accountant

With a national average salary just over $57,000, accountants earn right about the median (middle-point) salary. In other words, this profession is as close as we’ll get to an idea of “the middle class.” So it’s no surprise most accountants sit in the middle quintile of taxpayers. However, there appears to be little relief in sight for anyone working this job. A best-scenario adds just $940 to a CPA’s pockets in 2018. In the worst cases, accountants would pay an extra $1,000.

Next: Steve Mnuchin didn’t draft the tax bill for these workers.

Fast food worker

Depending on seniority, fast food chain employee earnings fall between the lowest and second block of taxpayers. Despite what Treasury Secretary Steve Mnuchin told CNBC after the election, this group of workers will not see many benefits from the tax reform proposal. Lucky taxpayers would see breaks of $370 per year in 2018. On the other hand, those who fell through the cracks would see taxes rise an average of $530.

Next: These workers will wonder who is supervising the tax plan architects.

Office supervisor

Another distinctly middle-class position is office supervisor. This job offers an annual salary just above $56,000, landing the position in the “moderate-income” bracket in the Tax Policy Center analysis. According to Howard Gleckman, the center’s senior fellow, about one in seven people in this profession would pay $1,000 more in 2018. The other six would have to content themselves with a $660 tax break.

Next: The diverse group of people in this profession may get passed over by tax reform.

Wait staff

Is there a more diverse workforce than restaurant wait staff employees? Across America, you will find single mothers, struggling artists, high school graduates, and immigrants working this gig. Average salaries range from $15,000 on the low end to over $35,000 and up in high-end restaurants. These salaries represent multiple tax brackets, but none will win much at all with the plan for tax reform.

Next: Amazon hasn’t taken over this profession yet.

Retail salesperson

According to Department of Labor statistics, there were 4.6 million people working retail sales in 2015. That number made it the most common job in America. Surely, the most populated profession would be a beneficiary of Congress’s tax reform bill? Unfortunately, that won’t be the case. A retail sales associate might see an extra $160 per year once this plan runs its course. Those who don’t qualify will actually see taxes go up by $500 per year.

Next: There may be more work in this profession, but the tax situation will still need fixing.

Repair/maintenance worker

So many American households have multiple refrigerators, washing machines, and air conditioners these days. Looking at potential client pools, you might say it’s the peak time to be a maintenance and repair worker. Likewise, the average salary of $40,000 makes them viable for heads of household across the country. However, this profession stands to benefit very little from Trump’s tax plan. In at least 10% of cases, maintenance technicians would pay $1,000 more in taxes, according to the Tax Policy Center analysis.

Next: This type of stock does not go up every year.

Stock clerk

Amazon orders may be through the roof, but there seems to be little lag at drug stores and small markets around the country. Nearly 2 million people work these jobs in the U.S., and average salaries sit near $26,000 per year. As is the case for retail employees, tax relief will be limited for those working this profession. In some cases, it will be worse. Theoretically, employees of large companies like CVS would see wage growth once the corporation counted up its massive tax break. However, the trickle-down concept never really worked for Americans in the past.

Next: There will be no clean sweep for workers in this profession.

Janitor

Cleaning equipment may be more advanced now, but the grind of sanitation work is largely the same. It’s physical labor that wears on the body, and over 2 million workers dedicate themselves to it every day in America. As profitable ventures go, it’s also one of the lower-paying jobs, with average salaries around $26,000. The situation is unlikely to improve under the GOP tax plan. By the next decade, janitors may pay hundreds more in taxes every year.

Next: Nearly 3.5 million people working this job won’t win.

Cashier

Among the most common jobs in America, cashier places second only to retail work. Some 3.5 million people toil at a touchscreen or cash register on a daily basis, with average salaries near $23,000. It’s minimum-wage work more often than not, and there might be an extra $100 per year in it for the profession. If your tax filing puts you outside the group that benefits, Tax Policy Center estimated your taxes would go up $200 per year in the next decade.

While GOP members of Congress wanted to pass their tax plan in 2017, they sold it on its supposed benefits for average Americans. Certainly, tax experts argued that low-income workers would hardly benefit at all. Meanwhile, anyone who crunched the numbers saw that CEOs and the richest Americans would be the big winners.

Yet Paul Ryan said Corporate America, which got a 40% reduction in its tax rate, would pass along the riches to employees. In fact, Ryan released a statement saying his party’s plan would “create jobs, increase wages for workers, and level the playing field.”

There was one problem: The GOP tax plan included no guarantees for workers. If a company wanted to lay off thousands of employees, “tax reform” allowed them to do it. Or companies could simply pocket the money and boost their stock price. They could also just offshore the jobs to Asia.

Actually, all those things happened. Within weeks of the tax bill passing, America’s richest corporations started laying off workers. By February 2018, it became a feeding frenzy, with one company laying off over 5,000 employees to use its tax cuts for “restructuring.” Somehow, it looked like a bad deal for workers.

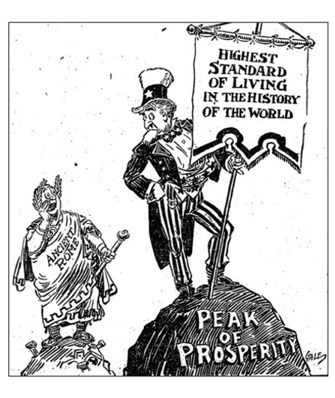

In the nineteen sixties and early seventies America had its highest real wages and a large trade surplus?

ReplyDeleteHas anyone heard any in government say they wanted to return America to that prominence that peaked in the nineteen sixties?